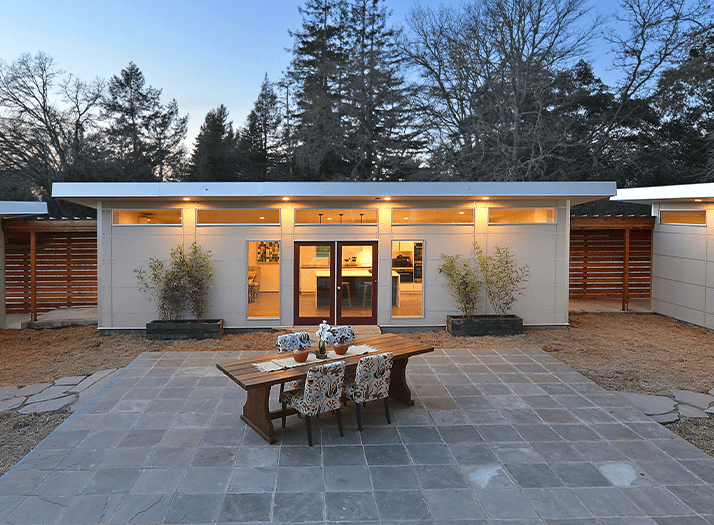

Discover the Ideal Financing Solution for Your Backyard Studio or ADU Project

Whether you're dreaming of a quaint backyard studio or a full-scale accessory dwelling unit (ADU), picking the right financing option is a crucial step in bringing your vision to life. Two leading platforms, Acorn Finance and RenoFi, offer solutions that cater to these varying needs. But which one should you choose? The answer depends on your specific project size, requirements, and financial considerations.

Acorn Finance - Simple, Small-Scale Financing

For smaller backyard studios, Acorn Finance is typically the go-to choice.

Acorn's platform offers personal loans, which are unsecured, meaning they don’t require collateral like your home. Personal loans are great for smaller projects because they are quick to fund, don't require home equity, and come with fixed interest rates. Acorn Finance makes it easy to compare loan offers from top-tier lenders, ensuring you get competitive rates and terms. This ensures that your dream backyard studio can become a reality without breaking the bank or going through lengthy processes.

Learn more about Acorn Finance

RenoFi - Unlocking Home Equity for Larger Projects

When it comes to larger projects like ADUs, RenoFi shines.

RenoFi specializes in home equity lines of credit (HELOCs), which are ideal for substantial renovations or constructions. By leveraging the future value of your home after the ADU is built, a RenoFi loan can provide significantly higher borrowing power than a traditional home equity loan. This makes it possible to finance larger projects without draining your savings. Plus, with RenoFi, you're not just getting a loan — you're also getting a partner that helps navigate the complexities of construction financing, ensuring you can confidently build the ADU you've always wanted.

Learn more about RenoFi